Gambling Affect Mortgage

Indication of gambling or overspending can be seen by the lender and may affect your mortgage application. Can professional gamblers get a mortgage? The nature of gambling is unpredictable and even those who derive their income from gambling will experience periods of fluctuation. Will Gambling affect getting a mortgage? I’m going to need to get a mortgage in about 4 months as my place will be ready around that time. So I was wondering if gambling will affect me getting a. Indication of gambling or overspending can be seen by the lender and may affect your mortgage application. Can professional gamblers get a mortgage? The nature of gambling is unpredictable and even those who derive their income from gambling will experience periods of fluctuation. ONLINE gambling and evidence on your credit card statements of paying Paddy Power and other internet bookies is a 'red flag' that may stop you getting a mortgage, the Sunday Independent has learned.

- Gambling Affect Mortgage Payments

- Gambling Affect Mortgage Companies

- Gambling Affect Mortgage Insurance

Here’s a new one from the wonderful world of mortgage underwriting.

Over in Ireland, some mortgage applicants are reportedly being denied mortgages because they have online betting accounts, according to the The Herald.

Apparently, the presence of a betting account is being used as criteria to approve or decline a home loan application, despite the fact that it’s perfectly legal to gamble over there.

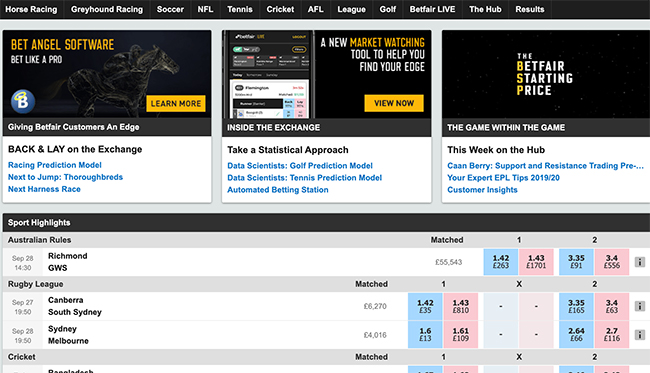

When prospective borrowers submit their loan applications, mortgage underwriters are taking an extra hard look at bank statements to see if deposits to online gaming companies show up.

If they do appear, it can be grounds for denial, especially for those looking to execute a loan modification.

Gambling Affect Mortgage Payments

The general thinking is if you’ve got money on hand to gamble, you really aren’t struggling as much as you say you are, and thus don’t deserve to have your mortgage payment negotiated lower.

What Does Distressed Homeowner Actually Mean?

It makes perfect sense, and calls into question what exactly “distressed homeowner” really means these days.

Is it a homeowner who lost their job and can’t keep up with mortgage payments because they’re stretched too thin, or is it a homeowner who was used to the “good old days,” who isn’t willing to give up his or her spending habits in light of the new reality?

While gambling is a glaring problem, mortgage lenders are also reportedly looking at mobile phone and cable TV bills when evaluating a borrower’s level of distress.

I guess you may need to give up both HBO and your iPhone if you want to get help from your mortgage lender or the government.

I’m not sure if they scrutinize those things stateside, but it’s hard to argue against it. A roof over your head is more important than what’s on the TV inside that home, right?

The takeaway here is that banks and lenders are getting more and more selective in handing out home loans.

Gambling Affect Mortgage Companies

So now more than ever it’s hugely important to do your homework, cross your T’s, and dot your I’s before applying for that mortgage.

[What credit score do I need to get a mortgage?]

Any mistakes or missteps could shut you out of the market, at a time when a super low mortgage rate could be the difference between staying in your home and renting.

In other words, be sure to take your time when applying for a mortgage. Don’t rush it, or you might be very sorry.

Read more:How to get the best mortgage rate.